In the late 70s, Indian banking veteran, HT Parekh set up Housing Development and Finance Cooperation (HDFC) to help Indians obtain a home mortgage loan, something that was unheard of at the time. He convinced a common man to take out a loan to build his home in Mumbai – and that’s how HDFC was formed and obtained its first customer.

With a strong inkling and a solid idea, even with some initial hesitation from the public about borrowing money for home building, Parekh took HDFC public just after a year of its inception. HT Parekh convinced his nephew, Deepak to leave his high-paying Chase job and co-lead the housing finance business.

Over the course of the next 10 years, HDFC started solidifying its positioning in the Indian banking sphere. It received a $4M line of credit from International Finance Corporation (IFC) and introduced new deposit products. It even got permission from the Reserve Bank of India (RBI) to accept deposits from Non Resident Indians (NRIs). By the mid-80s, HDFC had breached 1,000 towns in the country, had tied up with US Agency for International Development (USAID) for collateral, and even paid a 5% dividend to its shareholders. By the turn of the decade, HDFC had introduced products for Home Renovation and Home Expansion, all through its computerized Loan Processing System – by this time HDFC was approved over 100,000 loans annually.

In 1990, another significant moment arose in India’s economic policy – it allowed privatization of the sector and allowed Foreign Direct Investments in banking and other sectors. Deepak had been hoping for this for a while now as he was convincing the Board to open up a subsidiary private bank under the same banner. The objective was to diversity from home loans and open up the possibility for Indians to acquire personal, car, and business loans.

Currently, HDFC Limited has a market cap of $61B, with a 2023 revenue of $19B. It offers products in 4 categories – mortgage, life insurance, general insurance, and mutual funds. As of March 2023, its deposits were ~$19B, and loans were $78B.

Now to HDFC Bank – after a few years of back and forth, the bank was finally registered as India’s first private bank as a subsidiary to HDFC Ltd. Focus was to offer banking services to retail and corporate clients. Within the first couple of years as the first major bank in the country, it established a healthy reputation in the industry where its customers included leading multinationals, public sectors companies, and large domestic companies.

Throughout its initial years, HDFC Bank kept diversifying its product portfolios which included introduction of Certificates on Deposits, several Loan products, and started operating as a clearing house for regional stock exchanges.

HDFC Bank was regarded as the first bank to announce dividends, to launch a debit card (in association with Visa), to launch real-time online banking, and to offer mobile banking. With its listing on NYSE at the turn of the millennium, it was also the first private bank to collect income tax. Further growth spurred them to become market leaders in three major categories – Auto Loans, Personal Loans, and Credit cards. And with that they were also the first bank to introduce AI and robotic voice assistance to provide customer service with a humanoid on the other end (something that has gotten ultra-popular now with more or less every customer support industry but I personally don’t prefer).

As it stands HDFC bank (pre-merger) has a market cap of $130B and 2023 revenue of $24B. There are over 6,000 branches spread across 3,000 cities and towns, with about 50% of these branches in semi-urban/rural parts of the country and boasts of almost 70M customers. The bank offers retail banking, corporate banking, investment banking, and wholesale banking. As of March 2023, the deposit and loan value statistics for the bank were $235B and $200B respectively.

The Merger

Announced in April 2022, when the Board of Directors of both companies met and created strategic plays to amalgamate the two entities. The offer on the table was for that HDFC Bank will acquire its parent entity in a $40B all-stock deal. Given the highly regulated industry, the merger required the go-ahead of several finance and commerce regulatory bodies. And here is how it took place:

Some of the key reasons for this announcement were:

1. Regulatory Changes – Once the RBI tightened its regulations for Non-Banking Financial Companies (NBFCs) and Housing Financial Companies (HFCs) to prevent housing companies from defaulting and failing, it was less beneficial for HDFC Ltd to remain as and HFC without the support of a bank.

2. Low interest rates – The interest rates in the country were significantly low which allowed for higher capital to be borrowed at low rates which meant that there was more room for the credit and lending market.

3. The last, and somewhat important, reason was change in top-management. Aditya Puri, the long-time CEO of HDFC bank was never in favor of the merger, was retiring in 2020, which opened up the possibly of the incoming incumbent, Sashidhar Jagdishan, restarting the conversation around the merger.

Bank mergers are not easy and involves a significant time for due diligences, and this merger was no different. While on paper, the cultural similarities between the two were a plus, there were concerns about the technology issues given that both banks are handling such a heavy load of personal data and have very different operating structures. Some customers also raised their voice due to uncertainty of where their funds will sit and were worried about their potential returns being impacted. The issues that were highlighted were not unusual, but the overall process was much smoother than what we’ve seen in recent times.

Other than regulatory approvals, integration of both systems was also a concern. The biggest of them was the HDFC Ltd employees were mostly used to selling home loans, and would be equipped with the task of learning and handling a larger pool of products, which require a heavy time investment to bear fruitful results.

Finalized in July 2023, HDFC Bank led the merger of HDFC Ltd and the combined entity, operating under the HDFC Bank name, will bring complementary strength to the brand, enabling an enriching customer experience and relationship. Post the merger, HDFC bank customers will be offered mortgages as one of the core products in a seamless manner. As one of members of the Board said, “with this merger, one plus one will become 11 and not two” – which basically sums up the size and scale of the combined operations. This also presents cross-selling opportunities as 70% of HDFC limited customers do not have a corresponding bank account with HDFC Bank, and on the flipside, of all of HDFC Banks’ customers, only 2% have a mortgage with HDFC Ltd. The Boards of both organizations believe that with the long-term value from the merger, it also solidifies the governments impetus of “Housing for All” – something that worked in the favor of the proposal for the merger.

With a market cap of $170B, HDFC Bank becomes the 4th largest bank in the world behind JPMorgan, Industrial and Commercial Bank of China, and Bank of America, as highlighted by local news reports. And is ranked higher than other heavyweights such as Morgan Stanley, and HSBC.

The merger will allow the bank to write larger checks for loans and will allow it to provide more infrastructure loans, something which has growing in the developing nation.

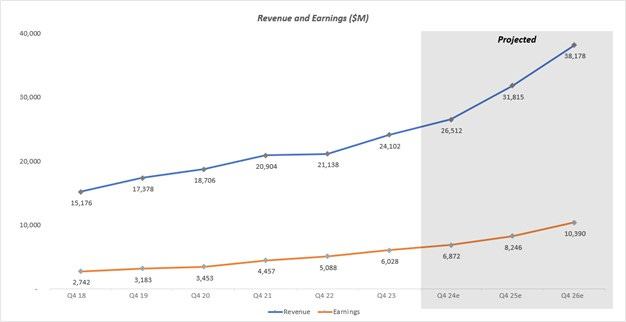

Let’s dive into some numbers now – the 5-year CAGR for Revenue and Earnings has been 8% and 13% respectively (based on annual reports), and analysts predict that, based on the merger, the forecasted 5-year CAGR until 2026 would be 13% and 15% respectively.

These predictions are based on several factors, and assumptions, such as banking capability, market factors and economic conditions, and competitor reactions. But the general theme is that the merger will create a stronger entity and drive higher growth both in terms of absolute revenue from the combined portfolio of products and their earnings after considering the respective costs.

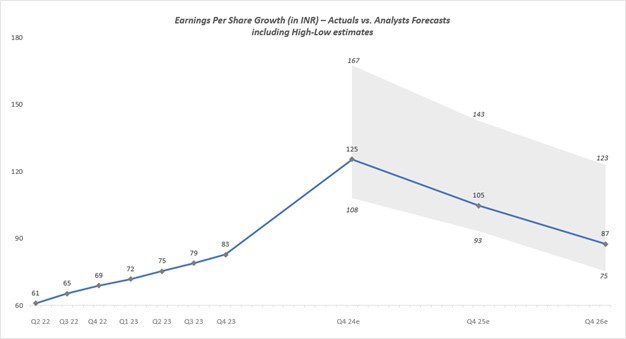

There were similar forecasts for the Earnings Per Share as well which compares the actual EPS vs. those that analysts predict based on the merger along with possible low and high values which shows that the 5-year CAGR of EPS until 2023 is at 4%, and projected 5-year CAGR till 2025 will be closer to 7% signifying heavier returns for shareholders.

Again, with every prediction comes assumptions. Here the analysts are assuming that the dividend payout ratio will not be negatively impacted from the merger. The High-Low predictions are performed keeping in the mind the general sentiment of the market, the competitive responses, and with one eye on the global macro factors due to the fluctuations in the US economy.

At the end of the day, the merger brought about a lot of positives for the companies and the Indian banking industry which included rapid share price explosion, a higher weightage for the bank on the national indices, and a pumped shareholder value. And with that a 20+ year vision comes to realization for Deepak Parekh, who, along with his right-hand man and left-had woman, all hang up their boots after seeing through one of the most impactful mergers in the country’s (banking) history.

Sources: HDFC, NDTV, The Tribune, CNBCTV18, Outlook India, Simply Wall Street